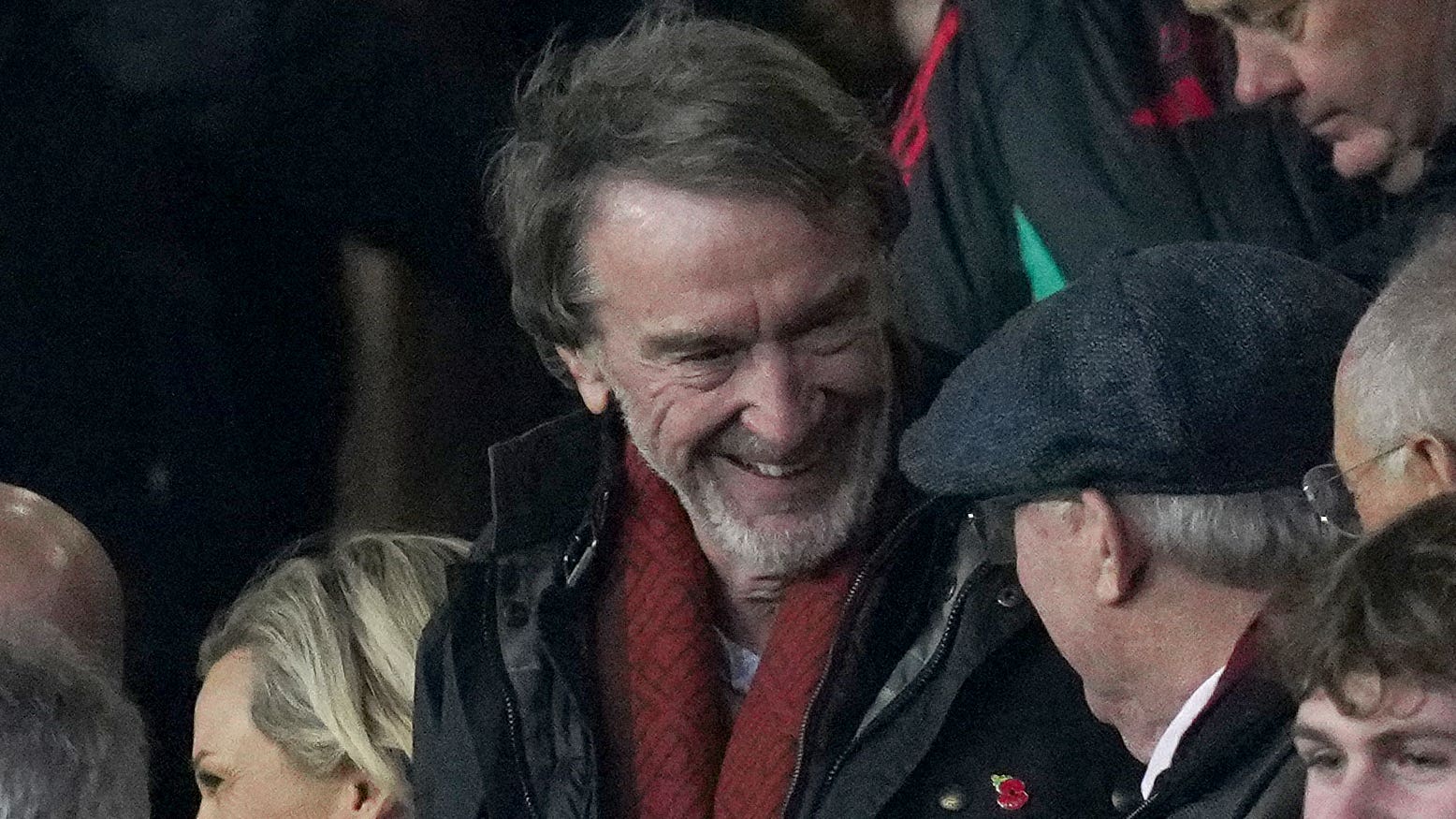

Sir Jim Ratcliffe has submitted his tender offer for 25 per cent of the Class A shares traded on the New York Stock Exchange as part of his deal to become the minority owner of Manchester United.

It was announced on Christmas Eve that the Ineos chairman had agreed to buy a 25 per cent stake in the Premier League club in a deal that included investing 300million US dollars (£236.7million) into their infrastructure.

As well as buying Class B shares held by the Glazer family, the announcement confirmed that Ratcliffe would offer to acquire up to 25 per cent of all Class A shares at a price of 33 US dollars (£26) per share.

Manchester United reaches agreement for Sir Jim Ratcliffe, Chairman of INEOS, to acquire up to a 25% shareholding in the Company.#MUFC

— Manchester United (@ManUtd) December 24, 2023

That offer from his company, Trawlers Limited, for up to 13,237,834 Class A ordinary shares was confirmed in a US Securities and Exchange Commission filing on Wednesday.

United’s Class A share price was 19.84 US dollars (£15.64) on December 22 – the last full day before the public announcement of Ratcliffe’s offer.

On the last full trading day before the commencement of the offer the price was 21.20 US dollars (£16.71) per share.

The document read: “The offer and withdrawal rights will expire at one minute after 11.59pm eastern time on February 13, 2024, unless the offer is extended or earlier terminated.”

The filing also said upon the consummation of the offer Ratcliffe’s shares would collectively “represent a 27.69 per cent ownership interest and 28.71 per cent voting interest in the Company”.

Earlier in the day United announced their first-quarter earnings for the three months ending September 30, 2023.

Published later than usual following the conclusion of the strategic review, it showed record first-quarter revenues up nine per cent at £157.1m.